Introduction:

In the ever-evolving landscape of finance, the integration of artificial intelligence (AI) has become a game-changer, particularly in the realm of credit scoring. This article explores the nuances of AI for credit scoring, shedding light on AI-based credit scoring and its impact on the traditional credit evaluation process.

I. The Rise of AI in Credit Scoring:

AI for credit scoring marks a paradigm shift from conventional methods. With machine learning algorithms and predictive analytics, financial institutions can now leverage vast amounts of data to make more accurate and informed credit decisions.

II. Understanding AI-Based Credit Scoring:

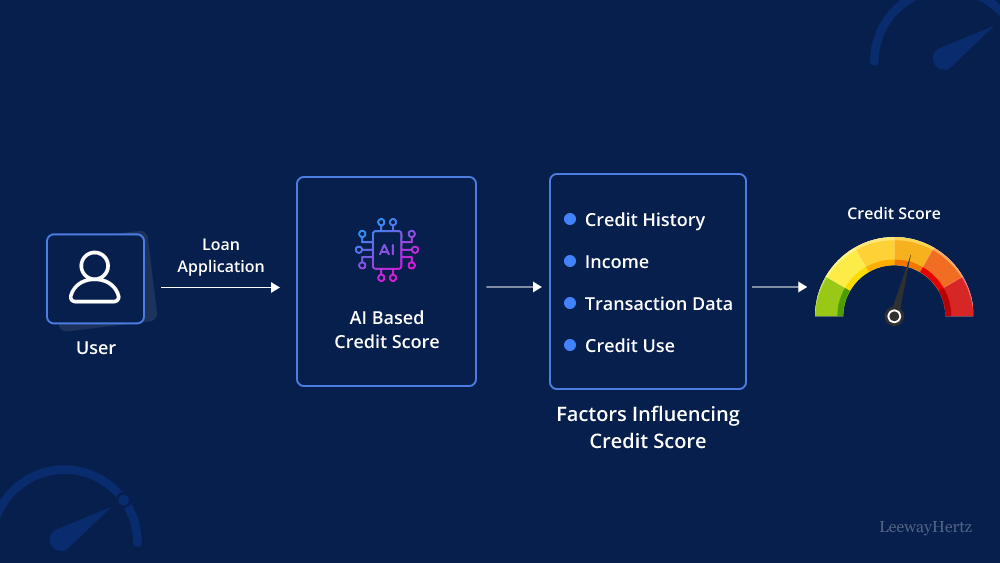

AI-based credit scoring involves the application of advanced algorithms to assess an individual’s creditworthiness. This method goes beyond traditional credit scoring models by considering a broader range of factors and data points. The goal is to provide a more holistic and nuanced evaluation of an individual’s financial standing.

III. Key Components of AI Credit Score:

1. Alternative Data:

AI credit scoring incorporates alternative data sources beyond the traditional credit bureau information. This includes factors such as social media activity, online behavior, and even utility payment history. By analyzing a diverse set of data, AI models can offer a more comprehensive view of an individual’s financial behavior.

2. Machine Learning Models:

Machine learning algorithms form the backbone of AI-based credit scoring. These models learn from historical data to identify patterns and trends, enabling more accurate predictions of creditworthiness. As the model processes new information, it continuously refines its predictions, adapting to changing financial landscapes.

IV. Benefits of AI in Credit Scoring:

1. Improved Accuracy:

AI’s ability to analyze vast datasets and identify intricate patterns leads to significantly improved accuracy in credit scoring. This can result in more precise risk assessments, reducing the likelihood of false positives and negatives.

2. Enhanced Speed and Efficiency:

Traditional credit scoring processes can be time-consuming. AI streamlines this by automating the analysis of data, providing quicker credit decisions. This is particularly advantageous in situations where rapid assessments are crucial, such as loan approvals.

3. Inclusion of the Unbanked:

AI-based credit scoring has the potential to bring financial inclusion to individuals traditionally excluded from the credit system. By considering alternative data sources, it can evaluate the creditworthiness of individuals with limited or no credit history.

V. Challenges and Considerations:

1. Bias and Fairness:

One of the primary challenges associated with AI in credit scoring is the potential for bias. If the training data used to develop AI models contains biases, it can result in discriminatory outcomes. Ensuring fairness and transparency in AI algorithms is essential to address this concern.

2. Explainability:

AI models often operate as “black boxes,” making it challenging to explain the reasoning behind credit decisions. Striking a balance between the complexity of AI algorithms and the need for transparency is a key consideration in the adoption of AI-based credit scoring.

VI. Future Trends in AI Credit Scoring:

1. Explainable AI (XAI):

Addressing concerns about transparency, the future of AI in credit scoring involves the development of Explainable AI (XAI) models. These models aim to provide clear and understandable insights into how AI algorithms arrive at credit decisions.

2. Continuous Learning Models:

As technology evolves, AI credit scoring models will likely become more adaptive and capable of continuous learning. This means that the models can quickly adjust to new information and changing economic conditions, ensuring ongoing accuracy.

Conclusion:

AI for credit scoring represents a pivotal moment in the financial industry. While challenges exist, the benefits of improved accuracy, speed, and inclusivity position AI-based credit scoring as a transformative force. As technology continues to advance, the synergy between AI and credit scoring is set to redefine how financial institutions assess creditworthiness in the years to come.